ESG Reporting: Build credibility and trust in your company

Share this article

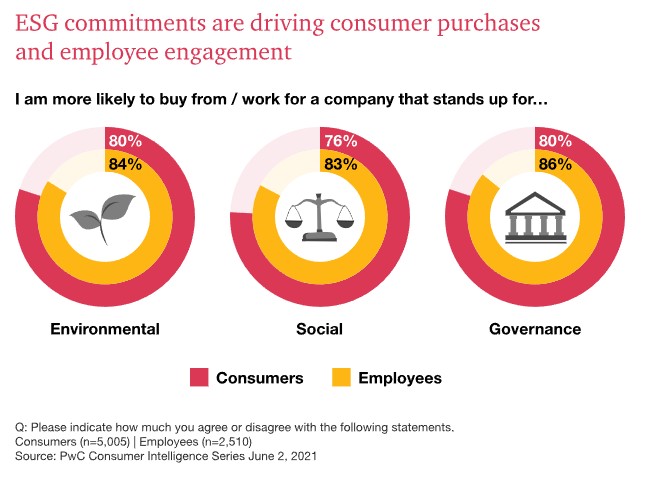

According to a recent study conducted by PwC, over 75% of consumers and employees care about ESG-related matters:

By giving such answers, consumers are effectively saying to large companies that they should spend more time and resources on diverse aspects of ESG. This question is especially important when it comes to reporting because consumers are simply not convinced that companies are doing as much as they can.

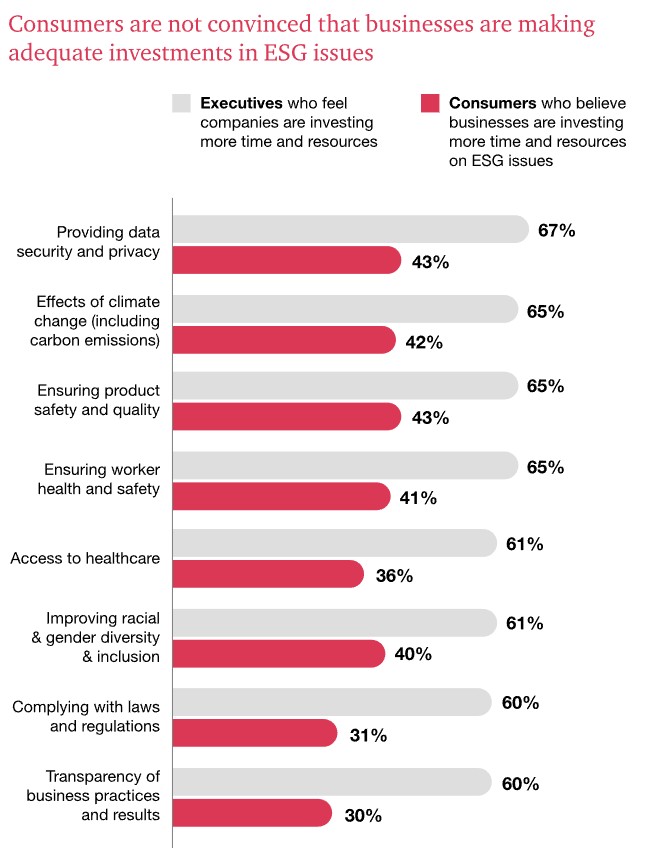

The same source indicates that while 65% of executives think their companies are investing enough time and resources to fight the effects of climate change (including CO2 emissions), only 45% of consumers share this conviction. The answers are similar concerning the following elements:

The conclusion is obvious – large companies need to pay more attention to ESG reporting if they want to build stable and trustworthy brands.

There are three main reasons why your company should focus on ESG reporting:

If you operate in the European Union, you are obliged to release ESG or sustainability information on an annual basis. Here, we especially mean the directive no. 2014/95/EU – the non-financial reporting directive (sometimes referred to as the NFR Directive). This directive lays down rules on the disclosure of non-financial and diversity information by large companies.

Under this directive, your company is obliged to disclose at least the following information:

As we’ve already mentioned, both consumers and employees are becoming more aware when it comes to companies’ ESG efforts. Showing that your company is actually doing what it claims it’s doing will help you gain trust and credibility among your target audience. This leads to:

In other words, if you want to build a strong brand, you must not only walk the walk but also talk the talk and be transparent about what your company is actually doing in those matters.

The value of your company can be perceived from many different perspectives, not just the revenue ones. PwC experts say that nowadays, investors and stakeholders monitor the values and trends of non-financial indicators to receive an overall picture of the company’s future performance and its current value.

This means that treating ESG reporting seriously can also enable you to drive more investors and market attention to your business and grow your market value.

Apart from what we mentioned so far, there are more benefits, e.g.:

Currently, the most common reporting standards in the European Union that your company can incorporate for its ESG disclosures are those issued by the Global Reporting Initiative (GRI) . GRI standards enable companies to report the impact of their social and environmental activities to stakeholders in an organised and streamlined way. There are over 40 documents providing the necessary support in such areas as:

However, GRI and other standards are typically just non-binding guidelines, and companies working on their ESG/sustainability reports have, in fact, a lot of flexibility concerning their reporting practices.

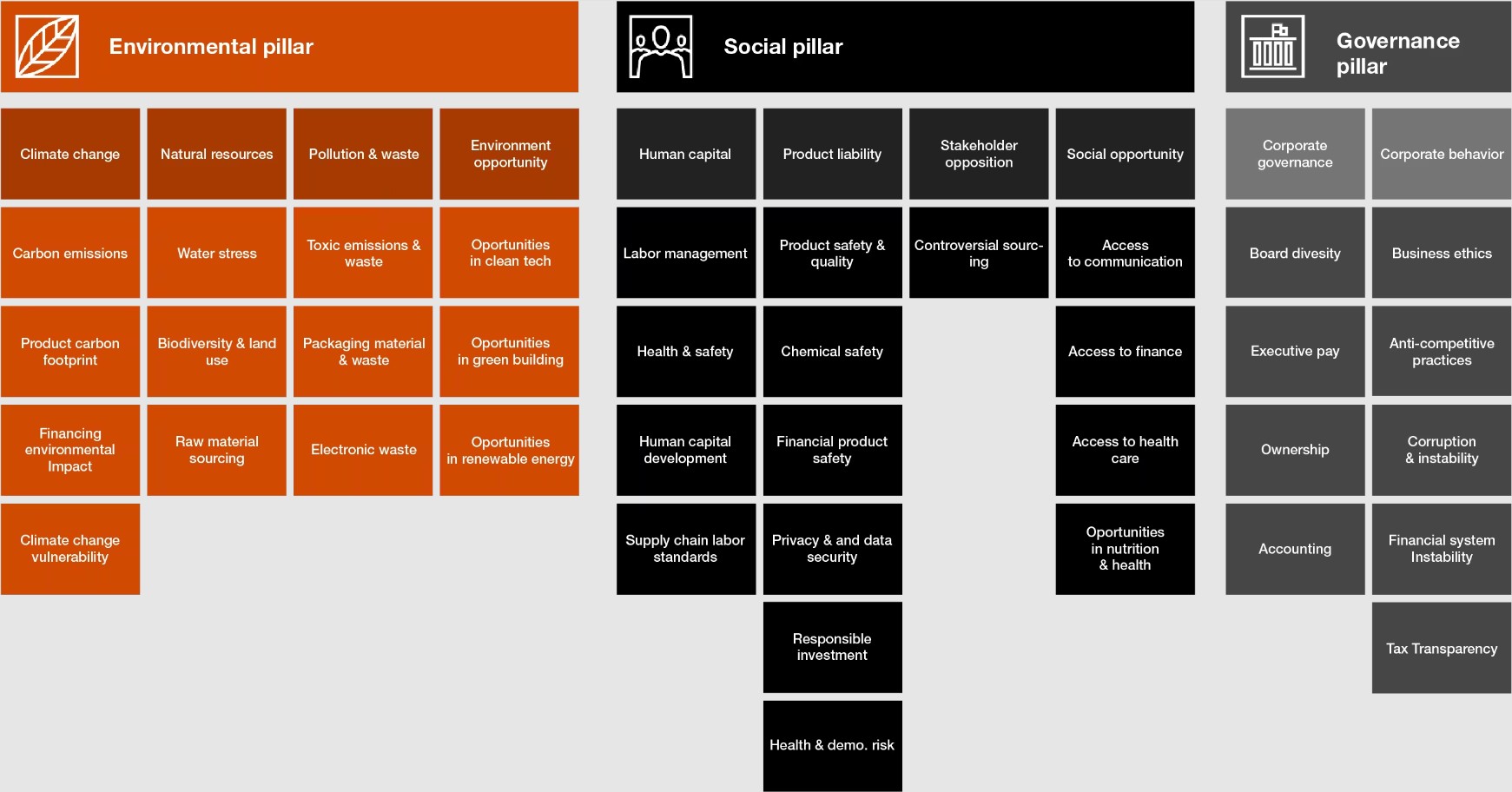

Typically, an ESG report should be based on three major pillars along with an in-depth analysis of all the relevant aspects and areas. Here’s a list you can use:

Source: https://www.pwc.com/sk/en/environmental-social-and-corporate-governance-esg/esg-reporting.html

This is a good starting point for your ESG reports.

In general, your ESG strategy should consist of specific measures and goals. During a year, you ought to focus on quantifying the company’s impacts and tracking progress. When the time comes to prepare a report for the past year, ensure that all significant ESG impacts for the reported period are included and allow stakeholders to assess the reporting of your company’s performance in the reporting period. It’s also a good idea to provide the wider context (the what and why, not just how) of sustainability and ESG topics in your business.

As we discussed earlier, your company has a lot of wiggle room concerning the way your report is done. From our experience, it’s crucial to focus on those five aspects of every well-designed sustainability report:

A good ESG report should be transparent, providing comprehensive information about your company’s performance, initiatives, goals, and challenges related to ESG matters. If there are things your company is struggling with, don’t hide them; show what efforts you take to deal with them. People will trust you more when they see you’re not trying to build this artificial, spotless image. Transparency builds trust with stakeholders and demonstrates the company’s commitment to accountability.

Your reports should focus on the ESG issues that are relevant to your company and its stakeholders. Focus on what your organisation is doing ESG-wise and why. This means identifying and prioritising specific environmental, social, and governance factors that have the greatest impact on the company’s long-term sustainability.

It’s essential for your ESG reports to include measurable data and key performance indicators (KPIs) that track the company’s progress toward its goals. This might include metrics related to, for example:

ESG is not a lonely island; it should be closely connected with your business profile and goals. For example, if you manufacture clothes, you can strive to limit the amount of polyester and other environmentally unfriendly fabrics. That said, a good ESG report should showcase how ESG matters are integrated into the company’s overall business strategy and decision-making processes. Moreover, this involves explaining how ESG factors are considered in such areas of your company as:

Have you ever read a report that needed ten pages to say absolutely nothing? Our advice is to choose a different path. Talk naturally about ESG, and show people that it’s not some witchcraft that only a few can understand. Use plain and understandable language and be specific. Keep in mind that your goal here is to build TRUST with your audience. Transparent, straightforward language is the best way to achieve this result.

At Admind, we do a lot of reports for our clients. One of them is ABB. Take a look at one of the annual reports we’ve made for them:

In general, we advise our clients to stick to digital reports (this also shows your care for the environment!), but if you decide to go with a printed version as well, that’s fine. It’s a good idea to use recycled paper to print such a report and limit the number of printed copies in favour of a PDF file.

As you can see in the screen above, the report is well-organised and not overloaded with information and data. There are many visual aids to make reading it a nice experience. All the crucial figures are distinguished by the large, bold font that attracts the reader’s attention.

That’s how a good ESG report should look! If you’d like to read more about this project, take a look at this post on our blog: Annual reports – your perfect branding opportunity

If your company is large enough to conduct and report ESG initiatives, make sure your reports are effective and good-looking. This way, you can strengthen your brand and gain the trust of your stakeholders and customers. And that’s crucial for your company’s success.

If you’re looking for a trusted partner who can help you design and create beautiful ESG reports, we’re happy to help. As a global branding agency, we’re here to help you build a strong and memorable brand.